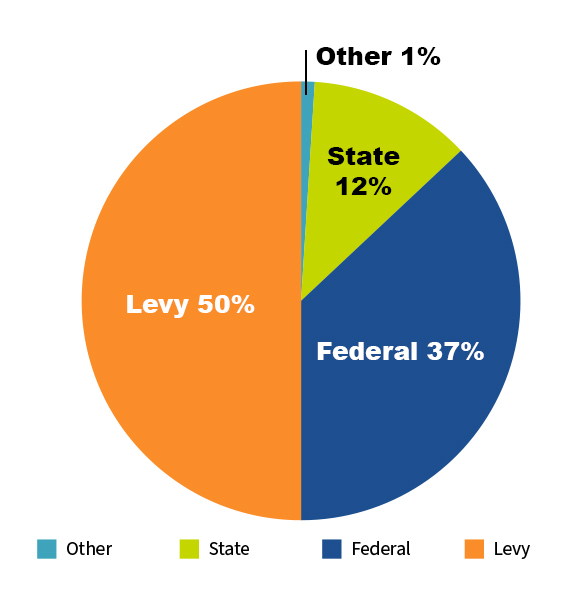

Lucas County Children Services operations are funded largely (50%) by two property tax levies that are periodically placed before voters for re-approval. Thirty-seven percent of the agency’s revenue comes from the Federal government, largely in the form of adoption reimbursements. LCCS receives about twelve percent of its funding from the State of Ohio, and the remaining one percent from other sources.

As of 2023, LCCS had an operating budget of approximately $55.65 million.

Also in 2023, LCCS substantiated more than 3,750 reports of child abuse, involving approximately 4,959 children.

2023 LCCS Revenue Sources

| 2023 Revenue ($US millions) | ||

|---|---|---|

| Levy | 50% | $27.77 |

| Federal | 37% | $20.34 |

| State | 12% | $6.9 |

| Other | 1% | $0.64 |

| TOTAL REVENUE | 100% | $55.65 |

| 2023 Expense ($US millions) | |

|---|---|

| Salaries & Benefits | $30.00 |

| Placement Costs | $19.35 |

| Child Welfare Contracts | $0.70 |

| Daycare | $1.83 |

| Other Client Costs | $1.24 |

| Intergovernmental Contracts | $2.23 |

| Other Contracts | $0.43 |

| Other Operating Cost | $3.44 |

| TOTAL EXPENSE | $59.08 |

*The 1998 levy replaced the 1982 levy, which was generating revenue based on 1969 property valuations. Because it was based on current property values, the reduced rate of 1.25 mills actually yielded more revenue than its 1.5 mills predecessor.

Levy C

| Year | Rate | Type | For | Against | Result |

|---|---|---|---|---|---|

| 2024 | 1.5 Mills | 5-Year New | 94,396 (54%) | 80,866 (46%) | Passed |

Levy B

| Year | Rate | Type | For | Against | Result |

|---|---|---|---|---|---|

| 2018 (Nov. 6) | 1.85 Mills | 10-Year Renewal | 107,547 (71/8%) | 42,237 (28.2%) | Passed |

| 2012*** (Nov. 6) | 1.85 Mills | 5-Year Renewal w/Increase | 108,520 (55.23%) | 87,966 (44.77%) | Passed |

| 2006 (Nov. 7) | 1.4 Mills | Renewal | 89,386 (63.49%) | 51,409 (36.51%) | Passed |

| 2001 (Nov. 6) | 1.4 Mills | 5-Year Replacement / Reduction | 68,448 (70.9%) | 28,075 (29.1%) | Passed |

| 1996 (Nov. 5) | 2.25 Mills | 5-Year Renewal | 105,961 (71.1%) | 42,999 (28.9%) | Passed |

| 1991* (Nov. 5) | 2.25 Mills | 5-Year Additional | 63,182 (53%) | 56,116 (47%) | Passed |

| 1986** (May 6) | 1.5 Mills | 5-Year Additional | 27,227 (57.7%) | 19,957 (42.3%) | Passed |

| 1981 (Nov. 3) | 1.0 Mills | 5-Year Additional | 71,305 (63.4%) | 41,170 (36.6%) | Passed |

Levy A

| Year | Rate | Type | For | Against | Result |

|---|---|---|---|---|---|

| 2020 (Nov.3) | 1.8 Mills | 1.80 mill Renewal (5 yrs.) | 136,836 (70.3%) | 57,863 (29.7%) | Passed |

| 2016 (Nov. 8) | 1.8 Mills | 1.4 mill Renewal + .4 Mill Increase | 117,383 (61.99%) | 71,961 (38.01%) | Passed |

| 2014 (Nov. 4) | 1.85 Mills | 1.4 mill Renewal + .35 Mill Increase | 50,346 (48.5%) | 53,405 (51.5%) | Failed |

| 2011 (Nov. 8) | 1.0 Mills | 5-Year Renewal | 83,070 (67%) | 41,198 (33%) | Passed |

| 2008 (Nov. 4) | 1.0 Mills | 5-Year Replacement | 127,210 (66%) | 65,788 (34%) | Passed |

| 2003 (Nov. 4) | 1.0 Mills | 5-Year Replacement / Reduction | 59,522 (59.9%) | 39,929 (40.1%) | Passed |

| 1998* (Nov. 3) | 1.25 Mills | 5-Year Replacement | 84,258 (69%) | 37,934 (31%) | Passed |

| 1993 (Nov. 2) | 1.25 Mills | 5-Year Renewal | 75,500 (70.7%) | 31,332 (29.3%) | Passed |

| 1988 (Nov. 8) | 1.25 Mills | 5-Year Additional | 85,295 (56.1%) | 66,630 (43.9%) | Passed |

| 1982 (Nov. 2) | 1.5 Mills | 5-Year Renewal | 82,842 (53.9%) | 49,353 (46.1%) | Passed |

| 1977 (Nov. 8) | 1.5 Mills | 5-Year Renewal | 118,368 (76.6%) | 36,248 (23.4%) | Passed |

| 1972 (Nov. 7) | 1.5 Mills | 5-Year Renewal | 108,005 (65.8%) | 56,035 (34.2%) | Passed |

| 1968 (Nov. 5) | 1.5 Mills | 5-Year Additional | 75,861 (50.4%) | 74,666 (49.6%) | Passed |

| 1967 (Nov. 7) | 1.5 Mills | 5-Year Additional | 41,665 (37.3%) | 70,034 (62.7%) | Failed |

*The 1991 levy replaced the 1986 levy with an additional 0.75 mills.

**The 1986 levy replaced the 1981 levy with an additional 0.5 mills.

*** Voters in 2012 approved a levy renewal and increase originally scheduled for the 2013 ballot to go into effect in 2014.